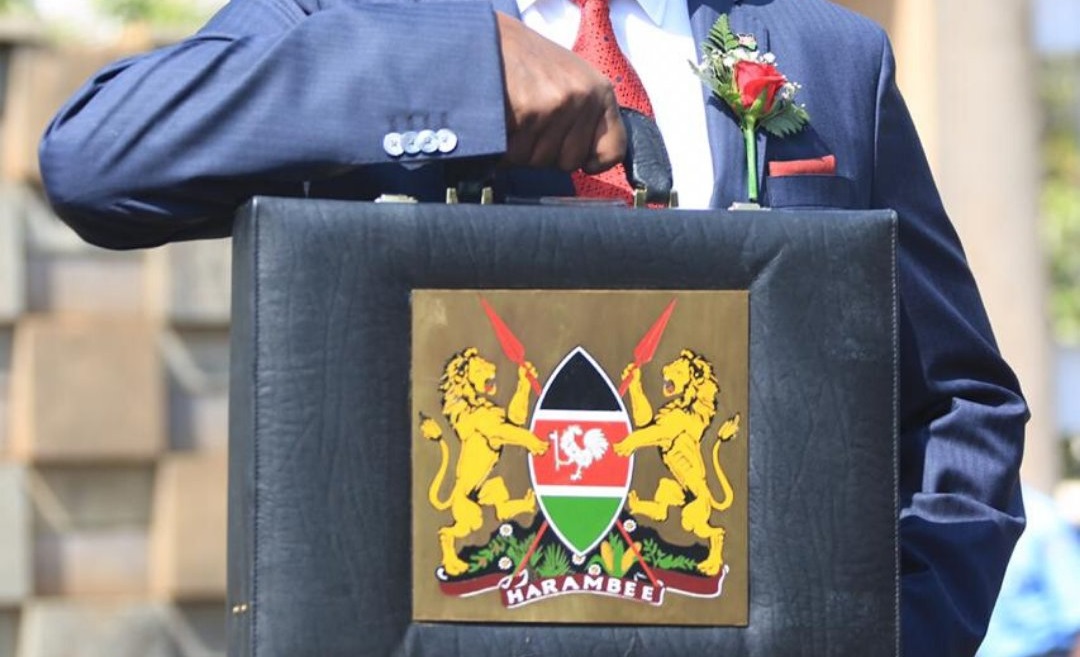

Kenya Budget 2020 Highlights – Treasury CS Ukur Yattani

Kenya’s Treasury cabinet secretary Ukur Yattani read the 2020/ 2021 budget today in parliament. The CS highlighted the Big Four Agenda and the COVID-19 pandemic as main determinants in the budget decision making process.

Budget Allocations

Kazi Mtaani program has received sh10 billion. This is to enable the program employ 200,000 youths, mostly from urban areas around Kenya.

The Nairobi Metropolitan Services was allocated sh26.4 billion in the budget.

Sh 5 billion was set aside to be used for rehabilitation of roads.

SGR phase 2 was allocated Sh 18.1 billion.

Ksh. 14B was the budgetary allocation for Sports activities.

To support the supply of locally made beds in hospitals, the Cabinet Secretary announced an allocation of sh 500 Million.

Konza phase 1B was allocated sh400 million while the Konza data center was allocated sh 5.1 billion by treasury.

Sh 25 million has been set aside for establishment of modern walk-through sanitizers. These are planned to be placed in hospitals and main border points.

Parliament was given sh37.3 billion. The amount is expected to be used mostly in supporting oversight.

Sh 52.8 billion was set aside for food and nutritional security, while 82.7 billlion was set aside for environment and water conservation.

To solve the frequent problem of floods across Kenya, Ukur Yattani has set aside sh 1 billion.

To support processing and registration of title deeds an allocation of sh1.6 billion was made by treasury.

An allocation of Sh4 billion will be used to waive KCPE, KCSE exam fees.

To enhance the fight against corruption, the Ethics and Anti-Corruption Commission and the Office of the Director of Public Prosecutions were each allocated ksh. 3.1 billion.

The Big 4 Agenda enablers and drivers which are an important policy of the Jubilee government have been allocated Ksh. 128.3 billion in the budget.

Ukur Yattani Tax Proposals

All companies will pay a minimum tax at the rate of 1% of gross turnover. This is to make sure all taxpayers contribute to maintaining Kenya’s infrastructure.

The Cabinet Secretary also announced a proposal to raise the threshold for rental income from Sh10 million per anum to Sh15 million.

Kenyans who made omissions in tax returns in the last five years will be given a three-year voluntary disclosure programme to pay the dues owed. This will have no penalties and interest.

Ukur Yattani also announced that all tax cheats were given a grace period of 3 years to declare correct taxes.

A digital service tax of 1.5% is proposed on value of transactions.

Sh38.9 billion is expected to be raised as revenue by treasury in the new tax measures.

Treasury’s Other Measures

The CS announced the Gazettement of a list of local procurement items to support the Buy Kenya, and Build Kenya initiative.

Prompt payment for contracts undertaken by enterprises owned by women and people living with disabilities.

Lifting the ban of holding meetings in private hotels so as to support tourism.

All pension payments backlog will be paid by end of the financial year.

CS Ukur Yattani directed to clear their pending bills by 30th June 2020.

All ministries, agencies, SAGAs and government departments that have not cleared their pending bills will have their allocations withheld.

The CS also announced that they are anticipating a fiscal deficit of 8.3% of GDP in the next financial year.

The impact of COVID-19 on the economy is being monitored, and this will lead to a review of budget fiscal plan including tax measures by the treasury, once the economy recovers.

As good news, the government has received several grants, including those from the following organizations: IMF – KSh. 78.3B, World Bank – KSh. 108B, African Development Bank- Ksh. 22.5B, and from EU- KSh. 7.5B .

See more News About Kenya’s Economy from the Kenya News Channel.

By Margaret Wanjiru.